Let’s face it. The question of how much options cost can be confusing. Fortunately, we’ve got some easy answers and clear explanations heading your way.

But first…

We are an investment firm that specializes in risk management strategies using options. If you’d like to receive our blog updates in the future, please join our newsletter on our website. Or, you can follow us on social media.

And now let’s get onto the blog!

What is an option, and how do I use it in my portfolio?

Let’s start with the basics before we get into the question of how much an option contract costs, shall we?

An option is a contract that gives you the right, but not the obligation, to purchase an underlying security at a certain point in the future.

- For example, you may own a put option that allows you to sell shares of a certain stock at $35 a share. If the stock plummets to $20, you can sell it for $35, saving yourself from losing the $15 you would have if you had sold it at $20.

- You may also own a call option on the stock, which allows you to buy it at $35 a share. If the stock goes to $50 and you can buy it for $35, you profited by $15. You essentially bought a stock for $15 less than what it is trading for.

For more option basics, check out this explanation from Investopedia.

Why options are important

Options can be used for hedging to protect your portfolio from a market downturn. This is especially useful for people who are close to or in retirement.

The way that financial advisors typically try to protect against market declines are – in our view – insufficient in many cases.

There’s rebalancing, or using market dips as an opportunity to reallocate capital to cheap asset classes. We’ve seen this work in a few cases but after a while it gets old, and clients get tired of hearing about how great it is to shift assets around while their portfolio is plummeting.

There’s diversification, or not putting all your eggs in one basket. However it’s questionable whether or not spreading the risk amongst different asset classes really shields the portfolio, since the major asset classes tend to move together. Hence, it’s earned the monker “diworsification.”

We favor hedging with options because we feel that it’s not what you own as much as how you own it. Options can provide you with exposure to the growth that certain asset classes can bring, but while also providing the potential to shield your portfolio from downside protection. There is a cost to using options, and we’ll cover that in a bit, but if you operate strategically this can be reduced. For these reasons, we see options as a tool that financial advisors can use to not just talk about hedging, but to actually hedge their clients’ portfolio.

How much do options cost?

Options are priced based upon something called Black Scholes options pricing model. This model renders a value for what the option’s price should be in the market at any given time. It is theoretical. It takes into account such factors as:

- Volatility of the underlying shares

- Length of the option

- Whether there are dividends or not paid on the shares

- Interest rates

- Current volatility

Remember when we said the Black Scholes model gives us a theoretical price?

What happens in the real world, when supply and demand factors take over, and the option price deviates from what the (theoretical) model says it should be?

Let’s say the options are trading in the market at a price that deviates from what the Black Scholes model would dictate…maybe by about 50 cents. In that case, the big market makers can come in and, through arbitrage, make that 50 cents a share back until the option gets priced back in line with Treasuries.

Whoa – here’s where we are at risk of getting a bit technical.

We’ll leave it to you to delve into the details of options arbitrage – this piece from NYU Stern does a great job explaining what options arbitrage is, in case you want to go down that rabbit hole. For the purposes of our discussion, we’ll leave it at this:

A model renders a theoretical price, the market participants come in and trade until any deviations from that price disappear.

Option costs make us want to puke

Option costs matter because they can put a big drag on your portfolio. Investors talk about using protective puts, for example, to limit downside risk.

This makes us want to puke.

There is nothing worse than paying a cost for options that you are never going to recoup. There are so many better ways to hedge with options that won’t cause you to lose value from your portfolio.

Here’s a better idea.

By purchasing options (instead of buying stocks or Funds directly), your portfolio may retain or even seek to increase its potential to capture increases in the market while potentially mitigating risk. Since the options require only a small fraction of your portfolio’s overall value, you can place the majority of your money into assets that are historically much more conservative. This way, you can increase your potential return while simultaneously limiting your risk. Even if the stocks go to zero, as long as the cash continues to earn interest, the losses may be offset by the growth in the cash account.

That’s actually how we do it at our firm.

This is just a description of a hypothetical scenario which may or may not play out this way in real life.

Our point is that you don’t have to believe the Wall Street hype and allow option costs to eat away at your portfolio. These costs are real, they can significantly reduce your portfolio’s value over time, and there are ways to hedge from downside risk while earning back the cost of the options you use.

Conclusion

We hope you enjoyed our explanation of what an option costs. Was it helpful? Feel free to send us a note with your feedback.

But wait!

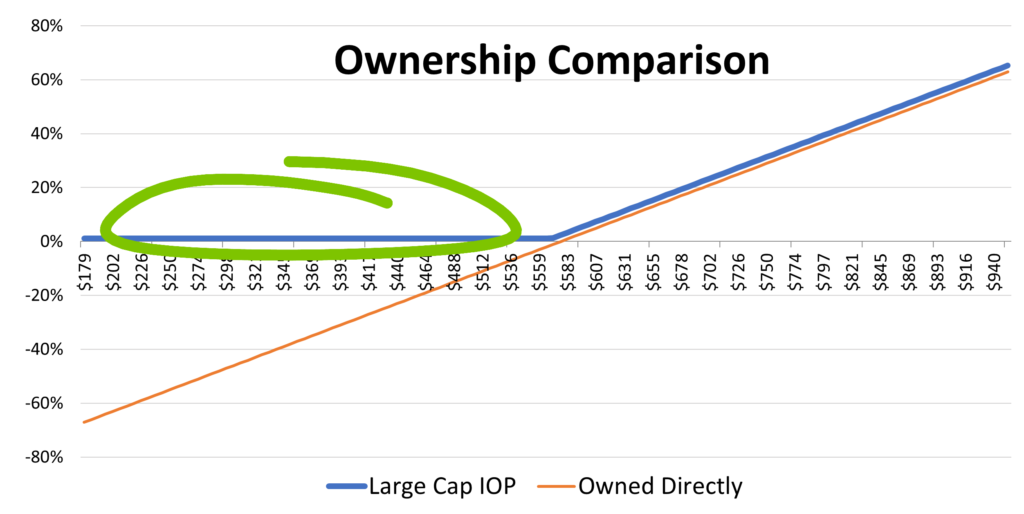

Before you go, one quick question. In a down market, would you rather have your portfolio be the green circle or the red line?

The red line illustrates the typical path of an unhedged portfolio during a market crash.

The green circle shows what is possible – that using options, it is possible to save yourself from losing your portfolio value when the market goes down.

As investment managers, we design portfolios that use options to protect clients from downside risk. Contact us if you are interested in learning about a different way of getting exposure to the market without having to own the stocks.

208-297-2710 or [email protected]

Thanks for reading and we’ll catch you in the next blog!

Disclaimers

Investors should carefully consider their investment objectives, risks, charges, and expenses before investing in the Integrated Options Portfolio (IOP), which may involve volatile put and call options and could potentially result in loss of principal. All investments carry risks and there is no guarantee that the IOP strategy will effectively protect against declines in value. The tax implications of the IOP can vary, and investors are advised to seek legal and tax guidance, as we are not legal or tax advisors.

This presentation includes hypothetical examples and is for informational purposes only. It should not be construed as a recommendation or solicitation. Hedging strategies, including options, cannot eliminate risk entirely and may involve additional costs. The content is confidential, and redistribution is prohibited.

For more information, please contact us at 208-297-2710 or [email protected].

© 2025 Desert Rose Capital Management Inc., SEC-registered investment advisor. All rights reserved. Insurance and annuity products are offered through US Life Pro, a licensed insurance agency and subsidiary of Independent Financial Partners.

Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All securities involve risk and may result in loss.